|

The best discounts on: Disney Tickets, Las Vegas Travel, Las Vegas Show Tickets, Best of New York. |

Things To Do and Places To Go

|

Try Yahoo! Travel for Cheap Airline Tickets

|

||||||||||||

Fall Foliage in Vermont

People travel from all over the world to see the Fall colors but even in the peak season there are always rooms available. If you want to avoid the huge crowds, travel mid-week. Another way to avoid the crowds is to travel the back-roads. Village stores or local inns are great sources of information for the best places to view the Fall colors. Besides scenic drives, Fall is also a great time to explore Vermont on a bike, in a canoe or hiking some of the beautiful trails. Enjoy a fall festival showcasing art, food, animals and more. Check out Vermont's Official Website for more detailed information. |

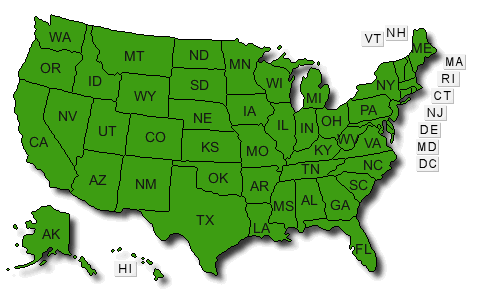

Click on a state to begin exploring Visit Australia! How to travel in this country Art Dictionary - for artists, collectors, students and educators |

Orlando is the largest family destination place in the United States. Disney World, Universal Studios, and SeaWorld there is no wonder why almost 60 million visitors from all over the world flock to the place known as "The City Beautiful." One of the best websites to visit if you are planning an Orlando vacation is www.orlandovacation.com. There are over 4500 pages informing you of everything you need to know. |